When the Dollar Is Falling, Here’s What You Can Do

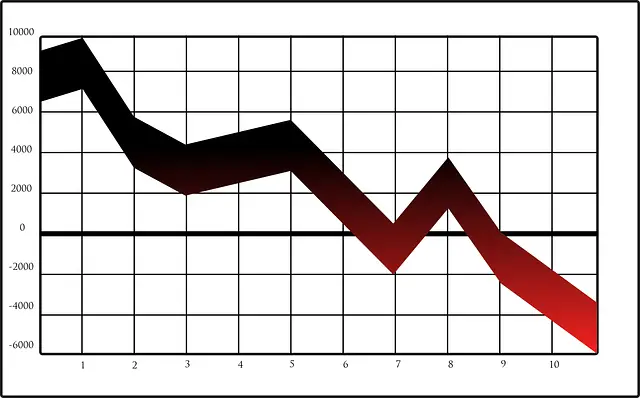

The value of the dollar is falling and that’s no secret. The Fed has maintained that it will keep inflation at an average of 2% “for some time.”

This means that interest rate will be kept at near zero until employment picks up. As a result, the value of our dollar will continue to erode as we enter a period of stagflation.

In this type of environment, saving is just plain silly. After all, when the idea of “high interest rate saving account” is no longer a viable solution, what’s the point of saving anyway?

As a strong advocate for saving money, it makes me sad that I can no longer support this thesis blindly. Instead, I’ll use alternative means to keep my purchasing power afloat.

In this post, we’ll discuss ways to combat a falling dollar and how to best use our money wisely so that our wealth can be preserved.

What to Do When the Dollar Is Falling

The Federal Reserve has implemented a series of monetary policies to combat the recent recession.

Basically, it has injected a large amount of money supply into the economy and kept interest rate artificially low. The hope of doing so is to keep economic activities high despite having record high unemployment.