Is it Time to Invest in High-dividend Stocks?

Experts said that corporate buybacks are plummeting and suggested investing in high-dividend stocks,

“Corporate buybacks are “plummeting” as companies tighten their purse strings, and it could have a big impact on the market, Goldman Sachs warned in a note to clients.

“Corporate buybacks are “plummeting” as companies tighten their purse strings, and it could have a big impact on the market, Goldman Sachs warned in a note to clients.

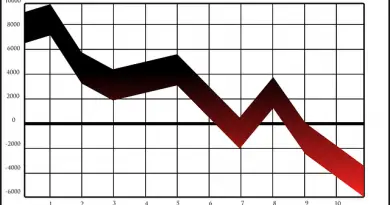

In the second quarter, S&P 500 share buybacks totaled $161 billion, about 18% less than the first quarter, the firm found. The amount spent on buybacks this year is down 17% from a year earlier, although it is on track to be the second highest total on record, Goldman said.

As corporate spending slows, investors hunting for yield should look to high-dividend stocks, the firm said.” Read more…

Skyrocketing technology stocks led the longest bull market in history during the 1990s, driving financiers to avoid stocks of dividend-paying companies.

The constant stock efficiency of more conservative firms just appeared pale in contrast. Now, the rising rate of interest and slowing corporate revenues are causing investors to again rely on the tried-and-true: premium companies with strong cash flows, strong incomes, and a healthy dividend stream.

A business that can dedicate to paying a routine dividend are ones that generally are positive and essentially strong about their future. A business’s dividend history is a good sign of its desire to share earnings and demonstrate accountability to investors. In durations of market unpredictability, these qualities become specifically appealing to financiers.

Stocks of business that pay dividends generally have less rate fluctuation than stocks of non-dividend payers. The dividend can smooth and develop a cushion out a stock’s cost volatility. It is very important to remember, however, that although dividend-paying stocks can include diversification to your portfolio and help lessen volatility, they still include threats.

The 2003 Tax Act added attraction to dividend-paying stocks. It decreased the tax rate for individuals on certified dividends from as much as 38.6 percent to simply 15 percent, depending upon your income tax bracket.

This appreciation for dividends has spawned a renewed interest in mutual funds that pay dividends like the American Century Equity Earnings Fund (TWEIX), which has been buying dividend-paying stocks for more than a year. The companies in the fund typically are basically strong and well-established, have steady earnings, a solid balance sheet and a history of paying dividends.

The size of dividends also is on the rise. 3 quarters of the business in the S&P 500 Index pay dividends, and more than half of them increased their payouts throughout 2004. That’s proof of a lot of strong balance sheets. A service needs to have the earnings to pay a dividend and a strong balance sheet to increase one.

Investors’ choice for dividend-paying stocks is most likely to continue, and so will the ability of numerous companies to continue paying dividends. A number of years of economic uncertainty have actually driven companies to cut expenses, reduce debt and check their capital spending. That implies a number of them now have a lot of cash on their balance sheets.

This combination of lower debt and larger cash swimming pools gives them the capability to increase dividends. Even with the current focus returning more cash to investors, the current dividend payment ratio is still below the historic average.

A company’s dividend history is a great sign of its desire to share earnings and demonstrate accountability to investors. Stocks of business that pay dividends typically have less cost change than stocks of non-dividend payers. The dividend can smooth and create a cushion out a stock’s price volatility. Financiers’ choice for dividend-paying stocks is likely to continue, and so will the ability of lots of businesses to continue paying dividends.