How to Protect Your Portfolio

CNBC recently reported a heavy loss by a hedge fund,

“One of the better-performing hedge funds reportedly took a heavy loss last month, as a big bet on Argentina’s economy went sour.

Autonomy Capital lost about $1 billion, or about 23%, in August after taking a large position in Argentina’s 100-year bonds, The Wall Street Journal reported on Wednesday. The hedge fund began betting on Argentina’s recovery last year, the report said.

Run by Robert Gibbins — who reportedly has a penchant for concentrated positions — Autonomy was managing about $6 billion at the beginning of August, the Journal said. Additionally, the report said that the fund had been doing well before the loss, gaining 17% in 2018. This year is marking a rebound for the hedge-fund industry so far, with widespread gains vaulting funds in the first half of 2019.” Read more

The key to successful long-term investing is protecting capital. This does not imply you need to sell your financial investment holdings the minute they enter the losing territory, however, you need to remain acutely familiar with your portfolio and the losses you’re willing to endure in an effort to increase your wealth. While it’s difficult to play it safe completely when investing in the markets, the following methods can help protect your portfolio.

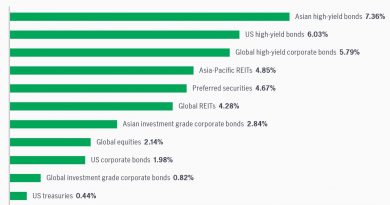

1-Diversification

Financiers produce deeper and more broadly diversified portfolios by owning a large number of investments in more than one possession class, thus reducing the unsystematic threat. This is the danger that comes with investing in a particular business as opposed to systematic risk, which is the danger associated with investing in the markets generally.

2-Non-Correlating Assets

Stock portfolios that consist of 12, 18 or perhaps 30 stocks can get rid of most, if not all, unsystematic risk, according to some economists.

Unfortunately, the organized danger is constantly present. Nevertheless, by including non-correlating property classes such as bonds, commodities, currencies, and realty to a group of stocks, the end outcome is frequently lower volatility and lowered systematic risk due to the fact that non-correlating possessions respond in a different way to changes in the markets compared to stocks. When one property is down, another is up.

In current years, nevertheless, proof recommends that properties that were once non-correlating now simulate each other, thereby reducing the technique’s effectiveness.

3-Put Protection Technique.

Between 1926 and 2009, the S&P 500 declined 24 out of 84 years or more than 25% of the time. Investors normally secure upside gains by taking revenues off the table. In some cases, this is a sensible choice. However, it’s typically the case that winning stocks are simply taking a rest before continuing greater. In this instance, you do not wish to sell but you do wish to lock-in a few of your gains. How does one do this?

There are numerous methods available. The most typical is to buy put options, which is a bet that the underlying stock will decrease in cost. Various from shorting the stock, the put offers you the option to sell at a specific cost at a particular point in the future.

You’re encouraged that its future is outstanding but that the stock has increased too quickly and is most likely will decline in worth in the near term. To secure your profits, you buy one put choice of Business A with an expiration date six months in the future at a strike cost of $105, or a little in the loan.

If the stock drops to $90, the expense to purchase the put alternative will have risen significantly. At this point, you offer the option for revenue to offset the decline in the stock rate.

It’s important to keep in mind that you’re not always attempting to make money off the alternatives however are instead trying to ensure your unrealized earnings don’t become losses. Financiers interested in protecting their whole portfolios rather of a specific stock can purchase index that work in the very same way.