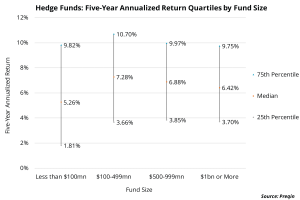

Hedge Fund Average Returns

You might be thinking to yourself “if I can't make a living out of investing then what do I have to do to make more money with my hedge fund?” After all, hedge funds are notorious for paying out extremely large amounts of money each year. This isn't good for your pocketbook, but it could make you one of the wealthiest men in America.

The answer is simple really and the same holds true for every type of hedge fund. A hedge fund is just a vehicle through which you invest your money to receive a much higher return than the average return for stocks or mutual funds.

For instance, if you were looking to invest in small businesses and get high returns on your investment then you would have to do things differently than if you were going to use a traditional fund. Many people choose to utilize hedge funds that specialize in making investments in companies that have been involved in some kind of financial catastrophe. These types of companies usually have a history of financial problems or they are on the shaky financial ground and need some form of infusion to be successful.

Some of these types of hedge funds are going to be very conservative and only invest in certain businesses that will be able to recover from their troubles. Other hedge funds will be quite aggressive and make a lot of trades each day trying to find the next big thing that will make them a lot of money.

There are also hedge funds that are going to be very interested in making investments in small businesses. These types of companies are usually on the brink of bankruptcy and are in need of some sort of money injection to help them out. Hedge fund investors who do this are typically very conservative because the companies need a lot of money in order to continue operating and to start growing again.

The trick to making money with any type of hedge fund is to find a good money management team that will work with you to determine the best investments for your needs. This means that you need to educate yourself on how the market works and how your particular hedge fund is going to be performing. You also need to learn how you can manage your portfolio so that it won't crash.

The picture above shows the average hedge fund returns.