Yen Currency Exchange Rate Analysis

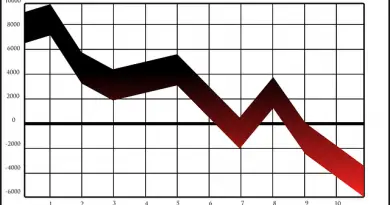

Global events are impacting Forex trading on a daily basis. Just this month the Japanese Yen retreated from 15 year highs against the dollar and 9 year highs versus the Euro. The recent strength in the Yen has been cited as unwarranted by current economic fundamentals. Now, amid fears and speculation, the Yen is pulling back.

Fears that the global market is slowing again are driving central banks around the world to new measures. The Forex markets are scared of possible Japanese actions. An intervention by Japan’s central bank, the first in more than six years, would aim to curb the rise in the Yen’s valuation. Japanese lawmakers feel a stronger yen will hurt Japanese stimulation efforts. A rise in prices could curb exports. Japanese Finance Minister Yoshida Noda has repeatedly told the markets he would “respond” to yen gains when necessary.

Weak U.S. data is also hurting the global economy, to which Japan is not immune. Global markets are slowing down again. Federal Reserve Chairman, Ben Bernanke, recently said that the Federal Reserve would reinvest monies from housing bonds into more long-term Treasuries. This is the latest move to prop up the fragile U.S. economy. Policy in the U.S. is so vital to the health of the global economy that the Bank of Japan’s Governor Masaaki Shirakawa attended the annual U.S. Federal Reserve Convention in Jackson Hole, Wyoming.

Why is the Yen important to Forex?

The Yen (JPY) is the official currency of Japan. It’s the third most heavily traded currency on the Foreign Exchange, after the U.S. dollar and the Euro. The strength and stability of the Japanese economy make the Yen attractive as a reserve currency, falling in right behind US$ and Pounds Sterling. Reserve currencies are monies held in significant quantity by governments and institutions as part of their foreign exchange reserves. This money is used as a base for trading in international markets, maintaining common rates for goods.

What are Yen?

Yen are the common currency of the country of Japan. The root of the word is the same as the Chinese Yuan. Yen literally means, “small round object.” Originally, silver and gold were traded much like the Chinese, in ingots. During the Spanish occupation of the Philippines many Spanish and Mexican coins were incorporated into the local Asian economies. These were the first yen and yuan. Eventually, the coins were so abundant that local governments began to mint their own “yen.” The first officially minted Japanese Yen were adopted by the Meji government on May 10, 1871. It was based on the standard dollar unit of the time, descended from Spanish pieces of eight. According to the Currency Act of 1871 a decimal counting system for yen was adopted along with a standard of value. Yen were to be round coins of silver weighing .78 troy ounces or gold coins weighing 1.5 grams. Because of its peg to silver, when the metal was devalued in the 1880s, the yen declined versus US dollars to a value of roughly fifty cents.

Yen in Modern times

After WWII, the Japanese yen was pegged to the US dollar through the Breton-Woods act. The Breton-Woods Act maintained currency exchange rates for several decades before being mothballed. This peg was intended to stabilize the Japanese economy and worked until 1971 when the U.S. abandoned the gold standard. Soon, a new agreement – the Smithsonian Agreement – re-pegged the yen to the US$ but that too fell to the wayside. Supply and demand pressures for international currencies soon led the world’s leaders to allow their currencies to float freely on the open market.