Is Mortgage Insurance Worth It?

Mortgage insurance is oftentimes an optional coverage for borrowers and can vary greatly between policies. A mortgage is a promise from a borrower to a lender that they will make payments on a specific date, based on the terms of their loan.

In the United States and many other countries, most policies require borrowers to have mortgage insurance in order to borrow money, but there are some policies that don't. In the United Kingdom, a borrower who is unable to repay the debt, or has less than ten thousand pounds of unsecured debt, and has not yet obtained a mortgage, may need to purchase mortgage insurance.

When it comes to buying mortgage insurance, there are many things to take into consideration, so that you are certain you are getting the right kind of policy. First off, you should know what type of mortgage you are interested in buying because different policies will offer different features.

Another consideration is how much risk is associated with the loan itself. Many types of insurance are required by the lender in order to complete the loan. For example, if the lender were to find out that the borrower was about to default on the loan, they could deny the loan and the lender could sell the property.

The reason for this requirement is that different types of insurance are designed to help lower your premiums. If you have a high-risk history, then you are going to pay more in premiums, and this will help lower your overall cost. If you are not willing to take a risk with your loans, then don't get mortgage insurance.

One important thing to do before purchasing mortgage insurance is to consult your current lender. Sometimes the lender will offer discounts to borrowers that have insurance, so this can save you money. Be sure to read the fine print before you decide to buy mortgage insurance.

One final consideration to make before buying mortgage insurance is whether or not the policy will be paid out in the event of foreclosure. Some policies only payout if you have a loan, and then you are required to pay them back on your own after foreclosure. Other policies will only pay out if your property is sold, and you are responsible for the mortgage.

Regardless of your choice, there are benefits to having mortgage insurance, so you shouldn't hesitate to buy it. Even if you are unsure, always speak to your current lender first, so that they can inform you of the pros and cons of the policy so that you know whether or not it is right for you.

Remember, just because it's affordable doesn't mean that it's a good idea to buy mortgage insurance. As long as you follow the guidelines above, and talk to your lender, you should be fine.

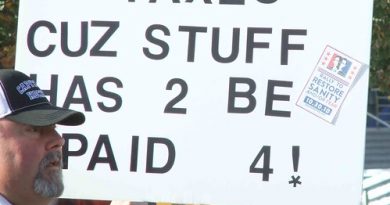

Photo by free pictures of money