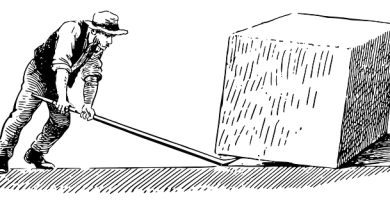

Leveraged Exchange Traded Funds

Leveraged exchange traded funds (ETFs) are investment vehicles that can generate high returns. Their returns are typically double or triple

Net Worth Is Misleading, Stick to Monthly Passive Income

You will find an endless number of posts on FIRE that include discussions about the central roll of net income

Leveraged Exchange Traded Funds

Leveraged exchange traded funds (ETFs) are investment vehicles that can generate high returns. Their returns are typically double or triple

Hedge funds hit after abrupt market pivot on vaccine

Several US and UK hedge funds were stung this week in an intense shake-up under the market’s surface triggered by